Wake County Property Tax Rate 2024 Neet 2017 – You can contact the tax administration to send a duplicate if you misplaced it. The mailing address is: Wake County Tax Administration Attention: 2024 Real Estate Revaluation PO Box 2331 . Wake County homeowners’ homes are expected to increase in value compared to 2020, but property taxes are not expected to jump as much as one might expect. Tax rate decrease proposed as new Wake .

Wake County Property Tax Rate 2024 Neet 2017

Source : www.brookings.edu

eolas Magazine issue 61 Jan 2024 by bmf business services Issuu

Source : issuu.com

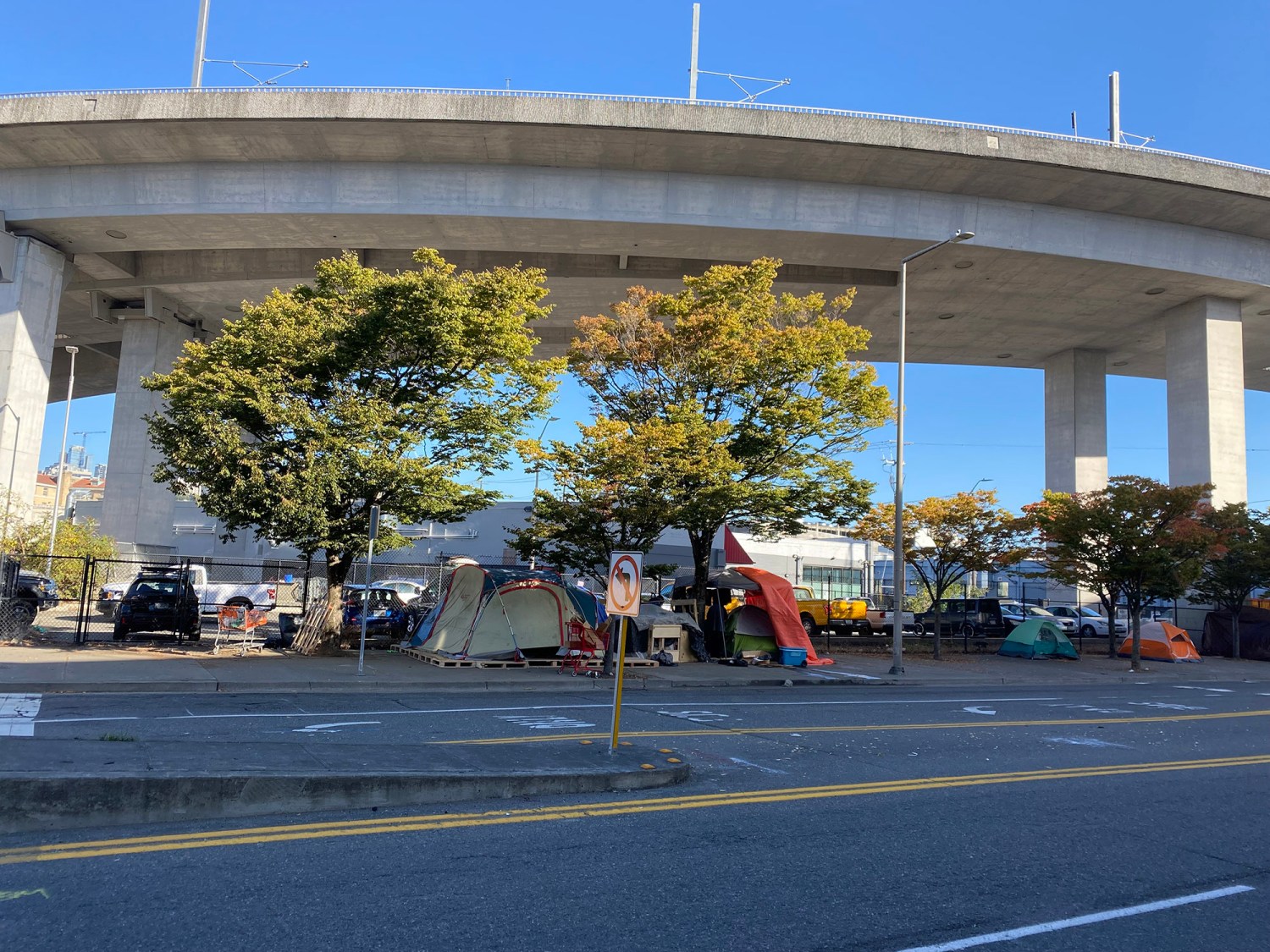

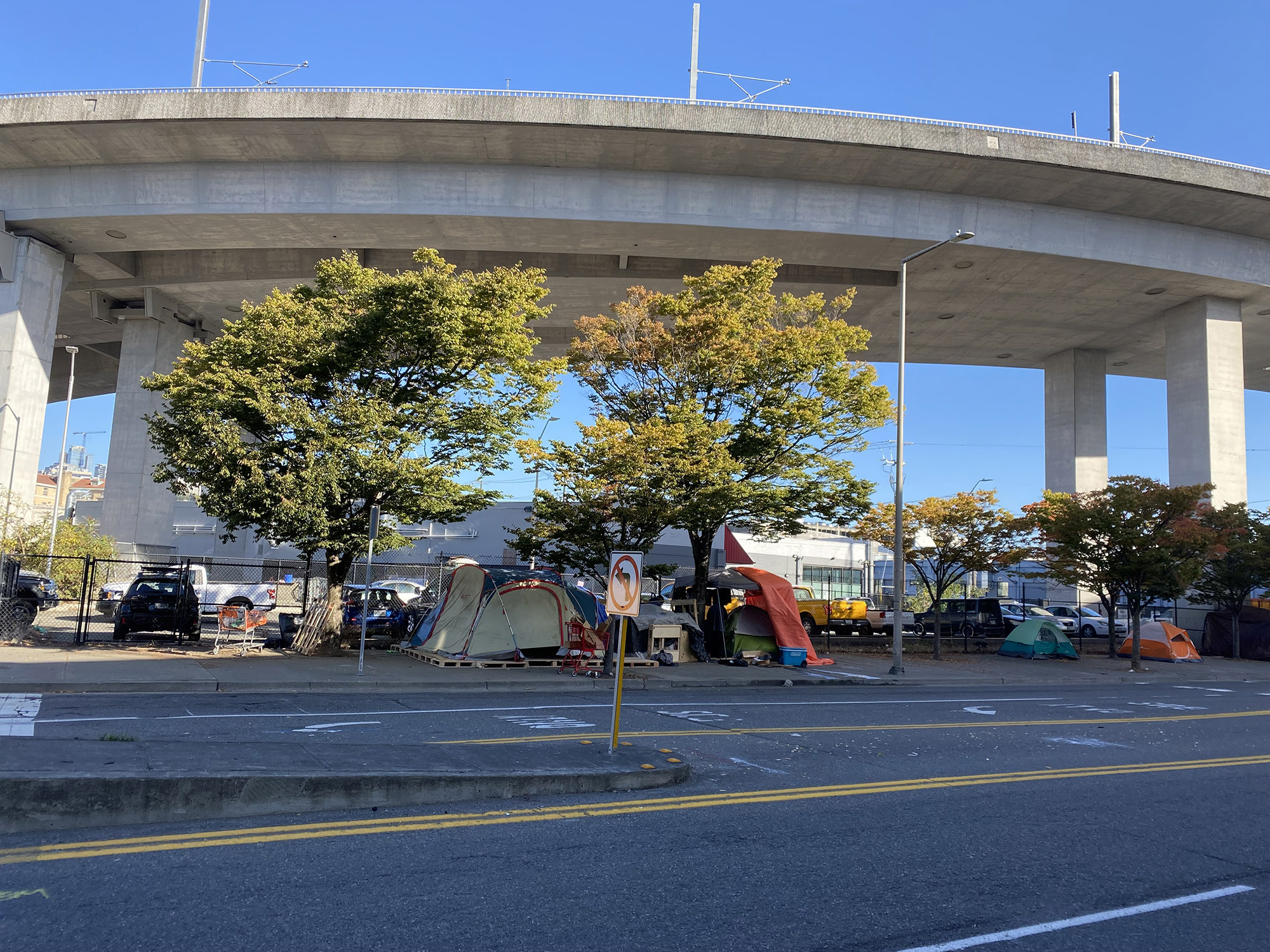

Homelessness in US cities and downtowns | Brookings

Source : www.brookings.edu

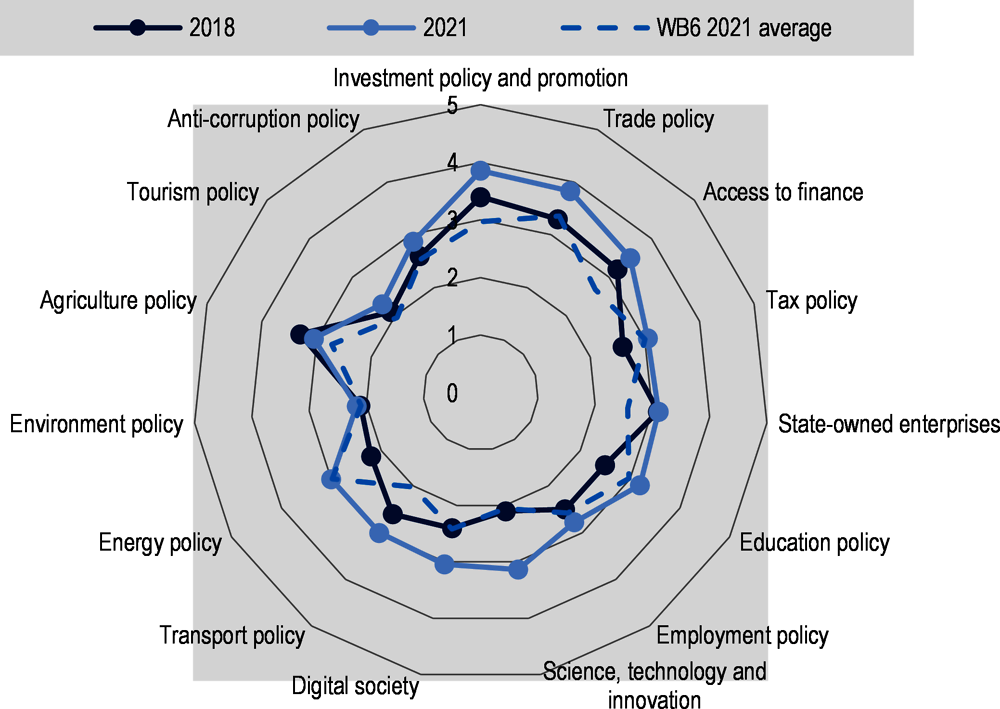

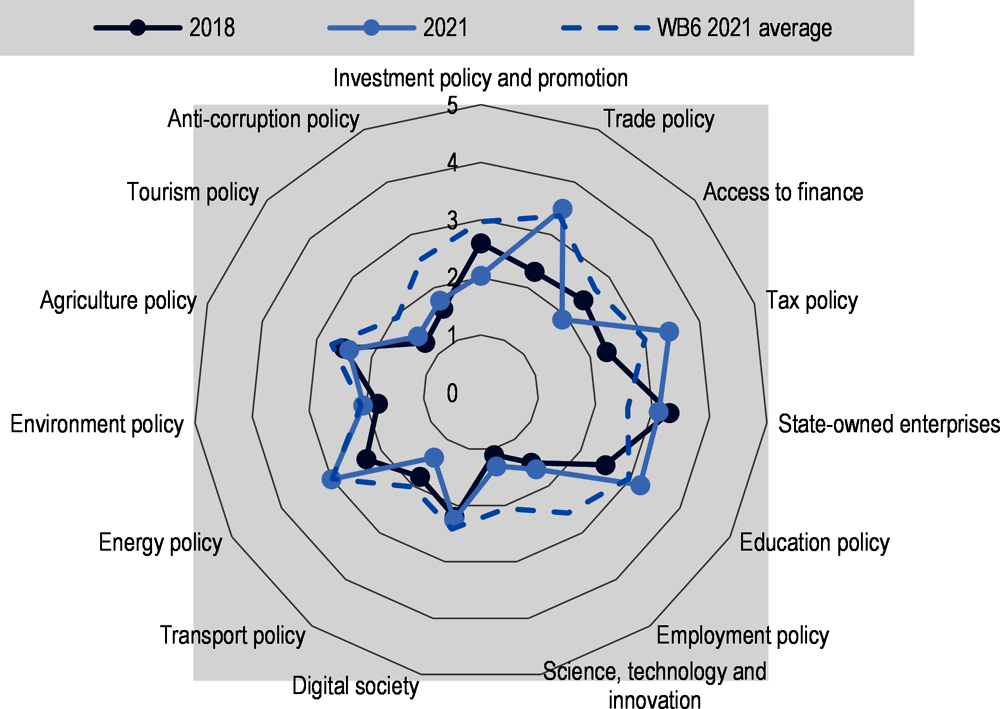

25. Serbia profile | Competitiveness in South East Europe 2021 : A

Source : www.oecd-ilibrary.org

Brunei Darussalam: 2019 Article IV Consultation—Press Release and

Source : www.elibrary.imf.org

City Weekly January 11, 2024 by Copperfield Publishing Issuu

Source : issuu.com

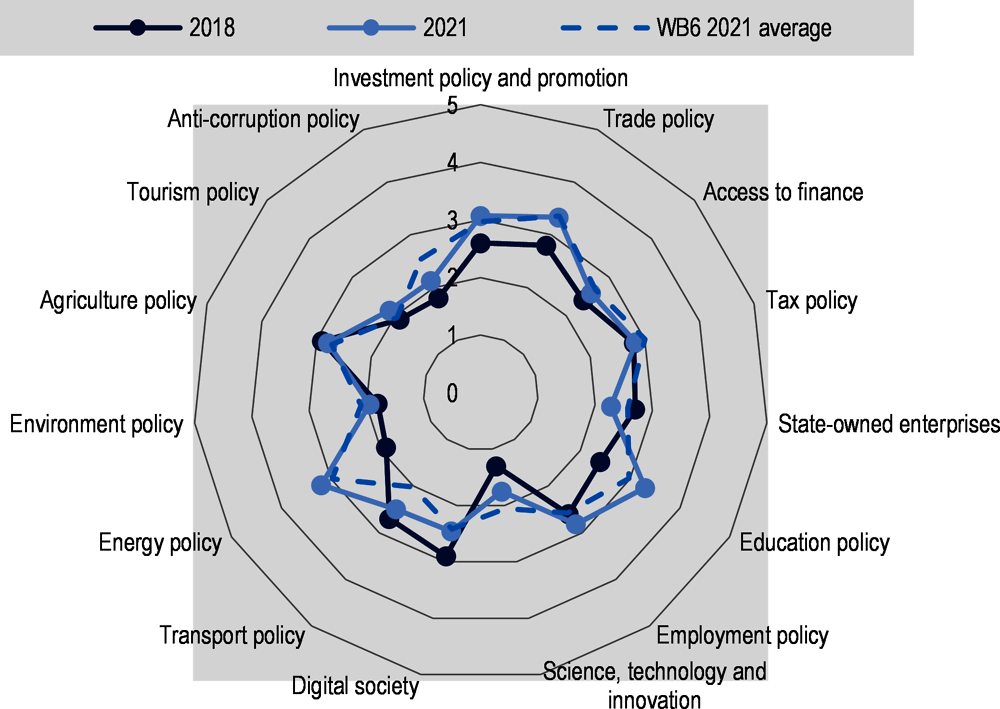

20. Albania profile | Competitiveness in South East Europe 2021

Source : www.oecd-ilibrary.org

OECD Economic Survey: United Kingdom 2017 (overview) by OECD Issuu

Source : issuu.com

22. Kosovo profile | Competitiveness in South East Europe 2021 : A

Source : www.oecd-ilibrary.org

EURER #8 Growth Over the Next Decade: Part 2 of Living Up to

Source : issuu.com

Wake County Property Tax Rate 2024 Neet 2017 Homelessness in US cities and downtowns | Brookings: Home values across Wake County have shot up in the past four years, according to newly released results of the county’s 2024 revaluation will set new property tax rates later this year. . New assessments are being sent out this week, and some people are reporting their home value soared as high as 80%. .